Different Type of Wallets in Copytrading

When it comes to copytrading on the solana network, we have to take into account the fact that there are different types of wallets, each of them having a different trading pattern to which we can adapt depending on our own style, risk management and portfolio size. That is why, in this detailed guide we will explore and explain the seven most common types of wallets that can be found out there and how to deal with each of them.

Before starting, you must understand that successful copytrading isn’t just about identifying wallet types, but about building a complete (copy)trading system that includes proper risk management and a deep understanding of the patterns you’re following. This guide will help you navigate these waters with confidence!

1. Alpha Wallets

The alpha wallets represent the cutting edge of copytrading, as they are the holy grail that everyone is looking for, since they are operated by individuals who have privileged access to project information before it is made public.

These wallets, such as the 4CykmDN6xfwgeczGHqKVTDoDZANL7LBMVBfHhKpfNg17 wallet, are normally a pattern of early entry into promising projects. Their trades usually precede the large volume of purchases in a token (i.e. they buy before the pump occurs), this being a very sought after indicator by copytraders, as this is how they can get the highest possible profits: Buying as low as possible and selling at the peak.

The key to identifying an Alpha portfolio lies in observing consistent early positioning across multiple successful projects. On the other hand, for a wallet to be Alpha, its ROIs have to be consistently high. It is not enough for this to occur on one or two rare occasions, because depending on its past behavior, it may be a simple lucky trade.

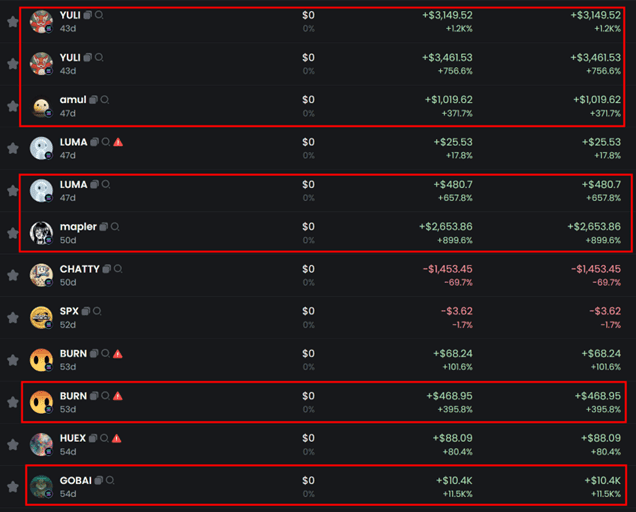

Returning to the example of the wallet mentioned above, it is clear from the image that the wallet knows something that the public does not, as it has incredible returns repeatedly on various tokens.

This is clearly confirmed by looking at its entry points on traded tokens (as can be seen in the three pictures below), as its incredible early entries (again, this is a common habit in this wallet) return him huge profits.

However, it is worth mentioning that, as is normal, an alpha wallet is not exempt from making losses, as in conventional trading, losing is part of the process.

2. Insider Wallets

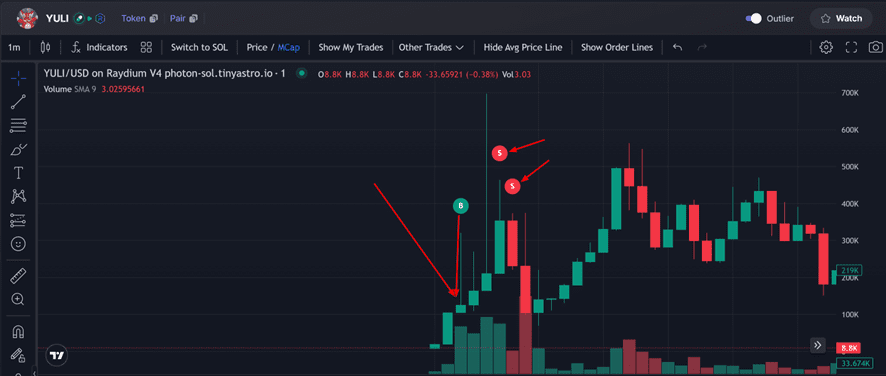

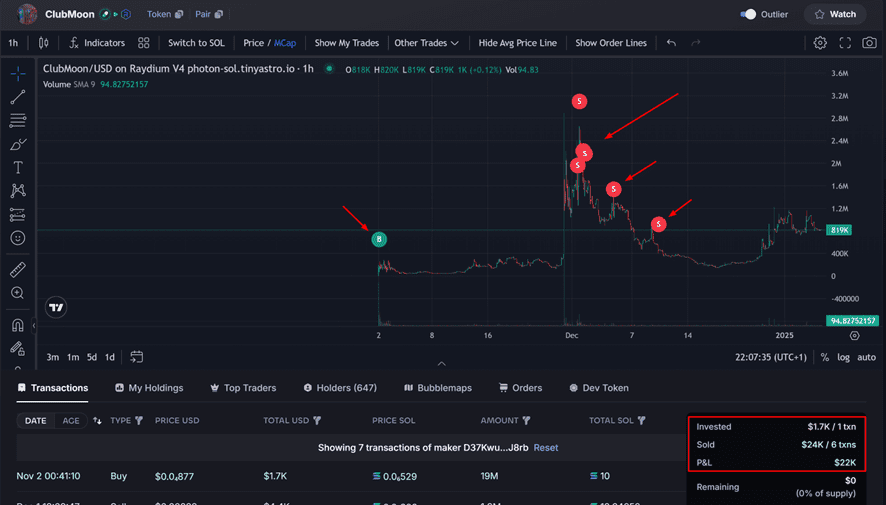

Insider wallets are considered the most sophisticated and secretive type of cryptocurrency wallets. A prime example is D37KwuoeLJJqVkD9EPaLD4zfwAZdp7WnH6BoJ5BPJ8rb. These wallets have several distinctive features that make them particularly challenging to find. When it comes to funding sources, they typically receive funds from centralized exchange Wallets (also known as Hot Wallets), making their transactions difficult or impossible to trace or reverse. What makes them stand out is their trading precision. They execute trades with remarkable timing, often buying tokens shortly before significant price increases.

The key distinction between insider and alpha wallets lies in their trading size. Insider wallets generally make larger purchases because they operate with privileged information, giving them higher confidence in their trades’ success. This allows them to invest more capital for greater returns.

A common misconception is that insider wallets only trade once before going dormant. In reality, they may continue trading actively, and while some trades might result in losses, they often maintain significantly profitable positions in other tokens, as demonstrated by the wallet mentioned above.

Taking once again the above wallet as an example, we can see how it has generated $69,500 in the last month despite several considerable losses.

The main challenge in tracking these wallets stems from their sophisticated operation method. Many true insider wallets receive their initial funds and later withdraw their profits directly to centralized exchange Wallets (also know as hot Wallets), making it extremely difficult, if not impossible, to track their activities or identify related insider wallets.

3. Sniper Wallets

Sniper wallets, as their name suggests, are specialized type wallets that focus on purchasing tokens at the earliest possible stage, within seconds of their launch. When we say seconds, we’re talking about transactions occurring in the very first blocks of a token’s existence, making them literally among the first purchases after the token developer’s initial deployment.

If you’re wondering how these wallets achieve such rapid execution, the answer is straightforward: They utilize highly sophisticated and automated software. This software, due to its extensive optimizations (and consequently its high cost), enables them to purchase tokens at the fastest possible speed.

As an example, let’s take the wallet ZDLFG5UNPzeNsEkacw9TdKHT1fBZCACfAQymjWnpcvg.

As can be seen in the picture below, this wallet does buy during the first (if not the first) blocks of a token’s launch indeed.

Finally, it’s important to note that while sniper wallets may appear highly profitable and attractive for copy-trading, this should be avoided. Their profits come primarily from their ability to purchase tokens extremely early through specialized software – something regular traders cannot replicate without access to the same sophisticated tools.

4. Human Profitable Wallets

Human Profitable wallets are considered the most reliable category for copy trading. These wallets display consistent and well-thought-out trading patterns that clearly indicate human decision-making, with moderate trading frequency and observable risk management strategies.

Their trades typically follow logical analysis rather than automated triggers or exclusive insider information, making them more predictable and secure for copy trading. The human element in their trading patterns usually translates into more sustainable and reproducible success.

What sets these wallets apart is their balanced approach to trading: they don’t rely on complex automation (like advanced trading bots) as sniper wallets do, nor on privileged information like insider wallets, but rather on solid trading principles and risk management that can be studied and replicated by other copy-traders.

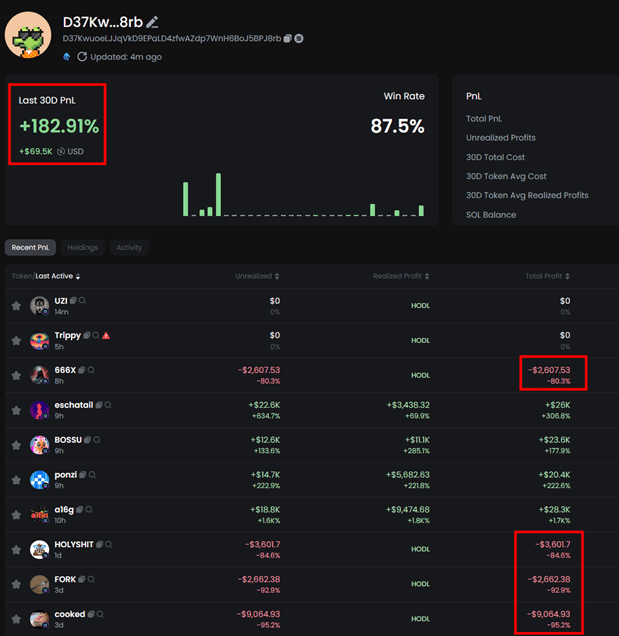

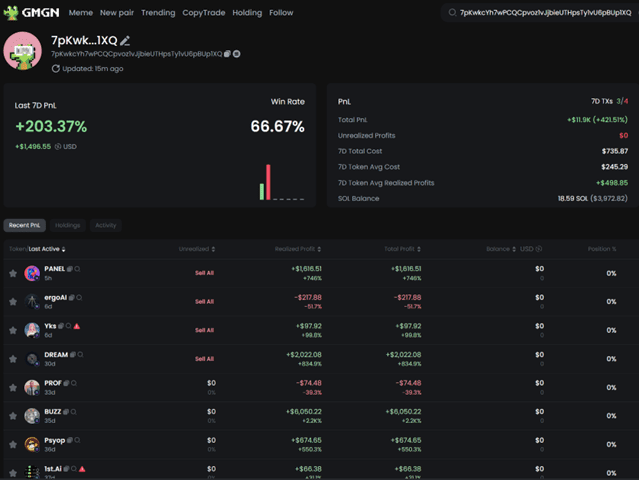

As a case study, we can look at wallet 7pKwkcYh7wPCQCpvoz1vJjbieUTHpsTy1vU6pBUp1XQ. Analyzing its behavior, we can observe that it’s a completely human-operated wallet, as despite having significant gains, it also shows some losses. Additionally, it has traded some risky tokens (those with the red danger sign), which is entirely normal and inevitable when trying to catch the next 100x token.

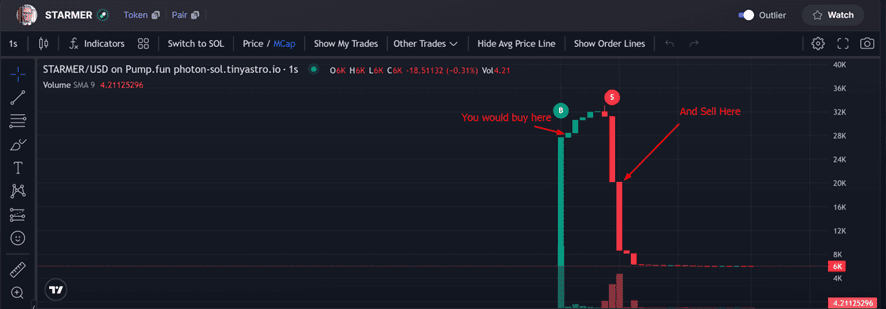

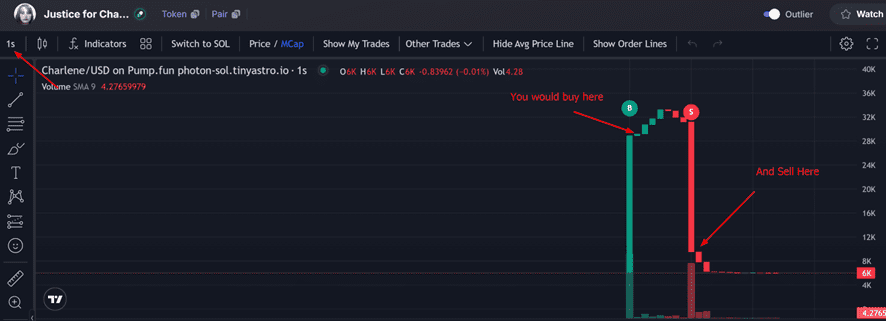

Similarly, when analyzing the entry points for their traded tokens (images below), we can clearly observe that they don’t buy in the first blocks (indicating it’s not a sniper wallet), but rather make purchases a few minutes after the token experiences a significant pump, which could even classify it as an alpha wallet.

5. Farmers

Farming wallets are perhaps the most dangerous wallets to copy trade due to their risky trading pattern: They buy a token, wait for their copytraders to follow suit, and then quickly sell taking advantage of the token’s price increase (caused by their copytraders’ purchases). This way, farm wallets make money through their strategic positioning while their copytraders lose money.

It’s worth mentioning that these types of wallets generally tend to trade low market cap and low liquidity tokens since price impact is greater with any purchase in these tokens, thus allowing for higher profits.

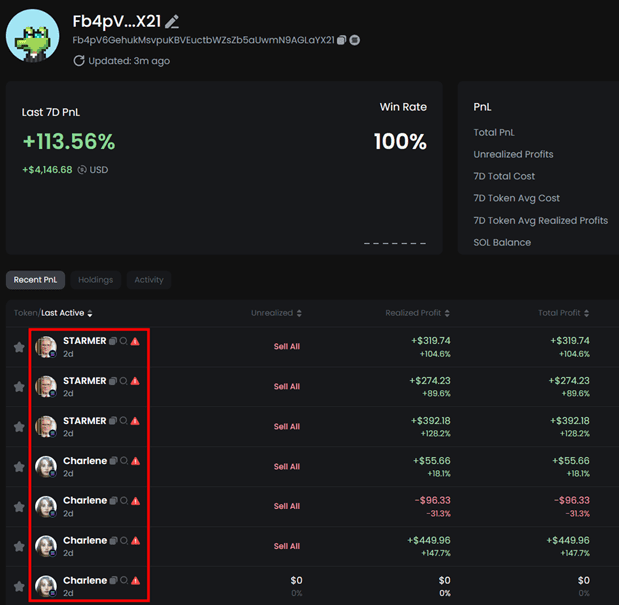

For example, analyzing wallet Fb4pV6GehukMsvpuKBVEuctbWZsZb5aUwmN9AGLaYX21, there are several things that immediately alert us that this wallet might be a potential farmer.

First, almost all of their tokens have the danger sign (meaning they are quick pump & dump tokens). Furthermore, they have traded several tokens with the same name and ticker (such as $STARMER, $Charlene, etc.), which is also a huge red flag.

Looking closely at these tokens’ charts to identify their buy and sell points, we can see that besides being tokens with very very low market capitalization, it’s almost impossible to be profitable copying these types of wallets, because as copytraders, we always buy and sell after the mirror wallet, which in this specific case means we’ll end up losing money while the farming Wallets profit.

In conclusion, copying these types of wallets should be avoided at all costs, as losing money is almost guaranteed.

6. Bundled Wallets

Next up we come to bundled wallets, which are perhaps the most difficult to detect.

To begin, let’s explain what bundled means: It basically involves acquiring a large portion of a token’s supply and distributing it among several wallets instead of keeping it all in a single one. This is done to try to evade security checks from different DEX platforms (DexScreener, Photon, Bubblemaps, etc.) with the aim of deceiving users into buying the token thinking it’s a legitimate project, since there isn’t any single wallet controlling a large part of the supply (although this isn’t entirely true, as the supply is being controlled by the same person(s) but distributed across multiple wallets).

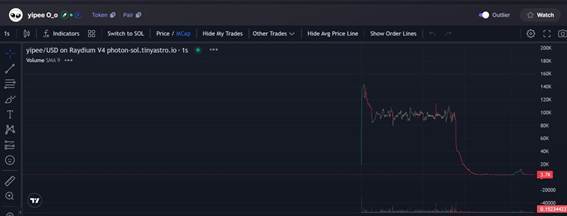

The way to identify a bundled token is relatively simple: You just need to observe the first candles after its launch (as this is where bundling occurs). If it’s enormous, there’s a high probability that the supply is being controlled by a few holders to later dump it while people buy. This can be seen in the images below.

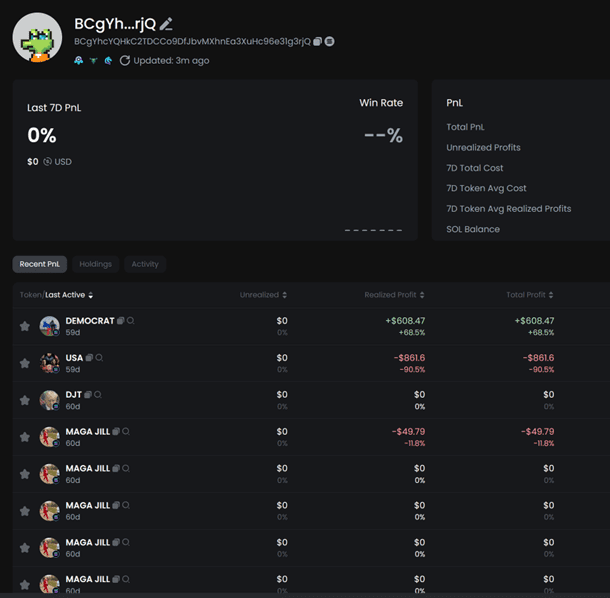

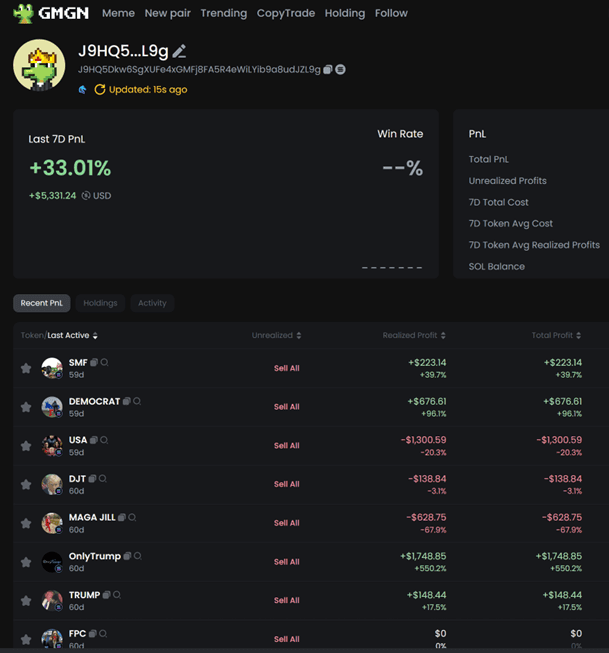

As for bundled wallets, these generally tend to be quite fresh (they don’t have many trades) and most of them (which are under the control of the same person) will have largely traded the same tokens (something that is very suspicious)… as can be observed in the illustrations below.

7. MEV Wallets

Finally, we come to MEV wallets. These are wallets entirely operated by highly advanced bots that exploit weaknesses in the Solana blockchain to profit. These bots employ sophisticated strategies such as frontrunning, sandwich attacks, and arbitrage opportunities across decentralized exchanges.

These wallets are characterized by their extremely fast transaction speeds and precise timing, often executing trades within milliseconds. They look for profitable opportunities in the mempool (pending transaction pool) and can place their transactions strategically to maximize profits. For example, when they detect a large pending trade, they can quickly insert their own transactions before and after to profit from the price impact.

MEV wallets typically show patterns of extremely consistent and rapid trading, with near-perfect entry and exit points. Their trading patterns are distinctly different from human traders because they operate at speeds impossible for manual trading. You’ll often see them execute multiple trades within the same block, something that would be impossible for a human trader to achieve.

For instance, the picture above is a real example of a MEV Wallet in execution. As can be seen, the wallet who bought and sold right after the 1 Solana buy is the same “LvLdh..”

For copy traders, attempting to mirror MEV wallets is essentially futile since normal traders cannot replicate the speed and precision of these automated systems. Additionally, these wallets often operate with significant capital and specialized infrastructure to ensure their transactions are processed with priority.

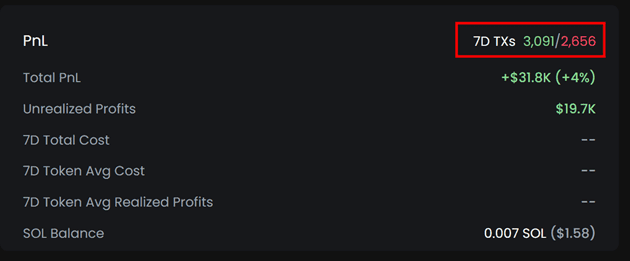

Identifying an MEV wallet when analyzing wallets is very straightforward: You just need to pay attention to the number of transactions in their last 7 days. Taking as real example the image below, we can see this wallet has executed 3,091 trades and 2,656 transactions in just 7 days, which translates to approximately 441 transactions per day or about 18 transactions per hour. Such a high frequency of trading would be practically impossible for a human trader to maintain, making it a clear indicator that this is an MEV bot operating with automated trading strategies.

The Reality of Hybrid Trading Patterns

While we’ve described these wallet types as distinct categories, the reality of copytrading is rarely so clear-cut. Think of these categories more as primary colors that can blend together in interesting ways. An Alpha wallet might occasionally try their hand at sniping a new token launch, or a typically Human Profitable wallet might sometimes display the characteristics of an insider trader.

This mixing of styles isn’t a flaw in our classification system. It’s a natural part of how real traders operate in the market. When you’re analyzing a potential wallet to copy, don’t get too caught up in trying to put it in a perfect box. Instead, look at its overall pattern of behavior across at least 10-20 recent trades. What you’re looking for is the dominant style, the go-to strategy that this wallet tends to rely on most often.

For example, if you notice a wallet that predominantly shows Alpha characteristics but occasionally executes some quick sniper trades, you should still approach it as an Alpha wallet. Just one that occasionally deviates from its primary strategy. This understanding is crucial because it helps you set realistic expectations for how the wallet might behave when you’re copying its trades.

Building Your Copytrading Strategy

Before you jump into copytrading, take some time to think about what kind of trader you want to be. This isn’t just about picking a wallet type to copy, it’s about understanding your own trading personality. How much risk can you tolerate? How much time can you dedicate to monitoring trades? What kind of capital do you have available? These questions will help guide you toward the right type of wallets to follow.

Once you’ve identified your preferred trading style and the types of wallets that match it, it’s crucial to implement proper risk management. This is where tools like Odin controls become invaluable. Regardless of which wallet type you’re copying or how promising their strategy looks, always start by setting appropriate limits on your trading activity. For example, you can use Odin’s maximum trades per day feature to keep your exposure in check while you evaluate how well a wallet’s performance translates to your copytrading setup.

Start small, even if you’re confident in your analysis. Live copytrading conditions can differ from what you observe in historical analysis, and it’s better to learn these differences with smaller positions. Monitor your results (and mirror wallets) carefully, and don’t be afraid to adjust your strategy based on what you learn. Remember, successful copytrading is an iterative process. Eventually, you’ll get better at it with time and experience.