How Liqudity Works and How

Affects Copytrading

Have you ever felt that sinking feeling? You eagerly follow a successful mirror portfolio that seems to know what it’s doing. It just keeps making profits, only to watch in confusion as their portfolio shows rising profits while yours bleeds red. It’s not just bad luck. It’s a carefully orchestrated liquidity dance that many traders fall victim to. The truth is, when it comes to Solana meme currencies, what you see in someone else’s portfolio doesn’t always tell the whole story.

That’s why, in today’s guide, we’ll explain how liquidity works and how it affects us when copytrading and how it can affect our trades, making you lose money in some cases while your mirror portfolio gains.

What is Liquidity?

Liquidity represents how easily you can convert an asset (like a meme coin) into cash or another cryptocurrency without causing significant price changes. Imagine a swimming pool: The more water it contains, the less impact a single person will have on the water level. This same principle applies to solana memecoins trading, where liquidity acts as the “depth” of the market. The higher the liquidity, the lower the price impact will be when a wallet buys/sells the given token.

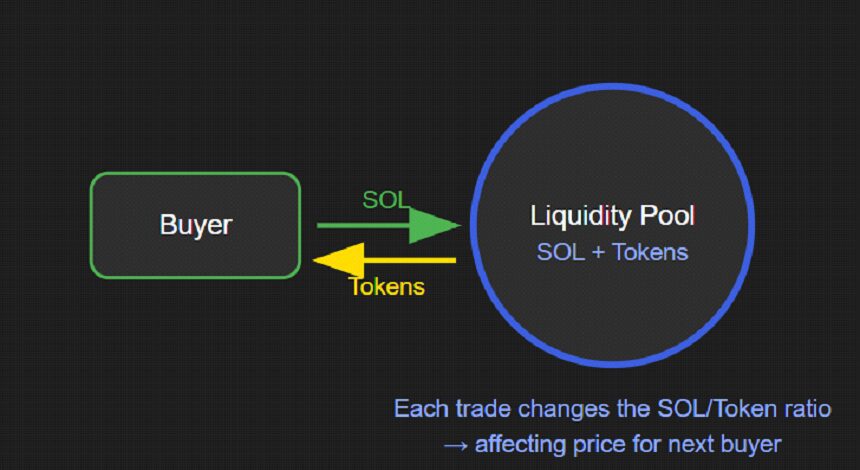

In decentralized exchanges, liquidity exists through what we call “liquidity pools.” Traders and investors deposit pairs of tokens into these pools. In our case (Since we are copytrading Solana meme coins), the meme coin will always be paired with SOL.

These pools operate using a mathematical formula called an “Automated Market Maker” (AMM) that determines prices based on the ratio of tokens present in the pool, but this is beyond the scope of this guide, so we’ll just skip it.

How Liquidity Affects Price Impact?

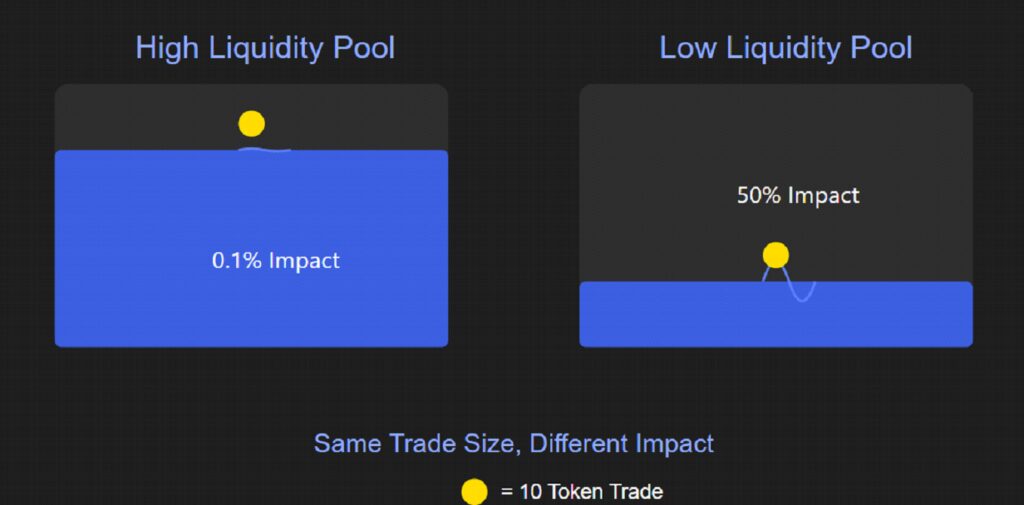

As shown in our diagram above, the same trade size affects prices very differently depending on the liquidity levels in the pool. In a high-liquidity scenario, trading has a minimal impact on the price, similar to throwing a stone into an ocean, where the ripples are barely noticeable. A trade worth 10 tokens might only move the price by 0.1%.

Conversely, in a low-liquidity scenario, even small trades can trigger dramatic price swings. It’s comparable to throwing that same stone into a small pond, where the impact becomes much more pronounced. That same 10-token trade might cause the price to move by 50% or more. This effect is particularly common with new meme coins, where the liquidity pool might be quite shallow.

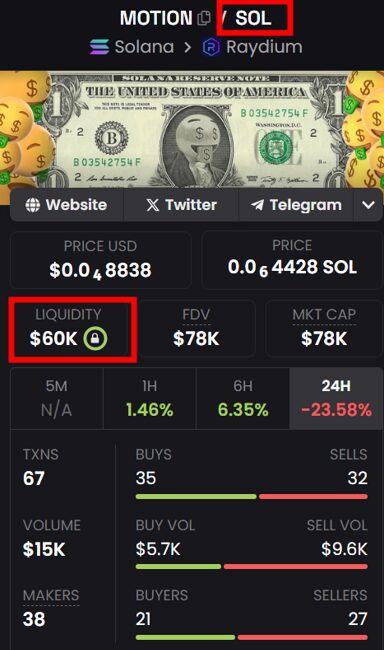

Showcasing a real example, let’s take a look at a 250$ sell on a token with low liquidity vs a 250$ sell on a token with high liquidity.

As can be seen in the contrast of the two images above, in the token with $4,000 of liquidity, a sale of 1.15 Solana has caused a 10% drop in price, while the token with $100,000 has barely noticed a similar sale, which impacted the price by only 0.61%.

Understanding Copy Trading Risks with Low Liquidity

The relationship between liquidity and copy trading is an aspect that many people overlook (and then wonder why they lose money while their mirror wallets gain).

Imagine you’re following a trader who buys a small amount of a token (say 1-2 SOL worth) when there’s very little trading activity. Because there’s such low liquidity, they get in at a very low price. However, when you try to copy their trade, something interesting happens:

Your buy order, coming right after theirs, actually pushes the price up significantly because there’s so little liquidity in the pool. In the example shown, while the original trader got in at around a $12,900 market cap, your copy of the exact same trade executed at about $16,500, which is nearly 30% higher!

Here’s where it gets tricky: If the trader you’re copying decides to sell right after (and you follow that sell), they might make a nice 20-25% profit, but you could end up with a loss. Why? Because you bought at a much higher price due to the liquidity issue.

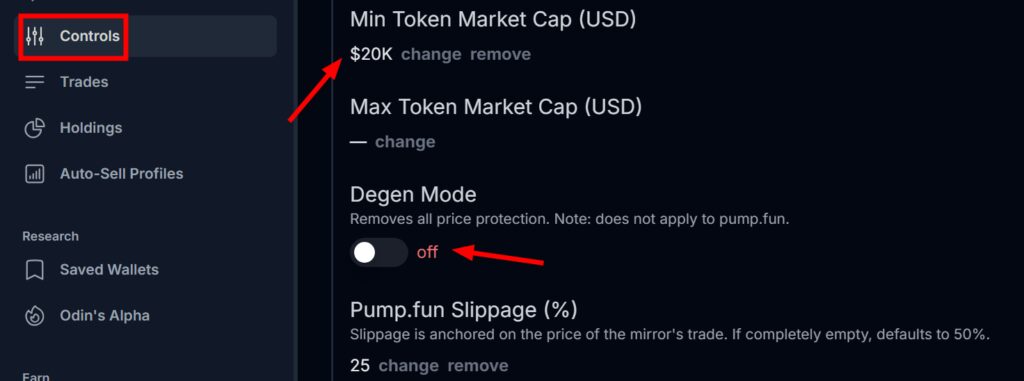

To avoid trading tokens with low liquidity, you can use OdinBot’s built-in features: First, keep Degen Mode disabled, this way, you will avoid copying a wallet if your entry price is significantly worse.

On the other hand, take advantage of the Minimum & Maximum Marketcap tokens features. For example, you can set a minimum of $20,000 (since in all pumpfun tokens, the liquidity is directly related to the marketcap. That is: the higher the marketcap, the higher the liquidity).

Final Thoughts

When you’re mirroring trades, pay extra close attention to wallets that frequently trade low liquidity tokens. While their gains might look impressive on paper, they’re often succeeding simply because they’re moving the prices themselves with their buys.

Look at the screenshot below: All those red warning signs are telling you something important: this wallet consistently trades tokens with dangerously low liquidity.

Remember, in these cases, what works for them likely won’t work for you. They get in first at better prices, while copiers end up buying higher and selling lower. It’s like they’re surfing the wave while you’re getting caught in the undertow. That’s why checking Gmgn.ai’s red flags is so crucial: The more warning signs you see on a wallet’s trades, the more likely you are to lose money while they profit.

The key to safe copy trading isn’t just following the most profitable wallets, it’s following those who make their gains through solid strategy rather than exploiting low liquidity. Your money is too valuable to risk on wallets that show these dangerous patterns.